Incoterms 2023: Meaning, Chart & List Of Incoterms

If you are shipping goods, knowing your incoterms is essential to understanding who is responsible for what in your supply chain.

Read on to learn all about incoterms and how to choose the right one for your shipment.

Incoterms in Plain English: The Incoterms Guide for Freight Shipping

What are Incoterms?

Freight incoterms (International Commercial Terms) are the standard terms used in sales contracts for importing and exporting. They are used to define responsibility and liability for goods over the course of a shipment. In other words, they spell out when responsibility for the goods transfers from the supplier to the buyer. They also define who pays which costs for the goods and their transport.

How Incoterms Impact Your Shipping Cost

You can use our freight rate calculator to help you decide how different incoterms will impact your freight cost. For example, when shipping EXW, you’ll be responsible for the added cost of getting your goods from your supplier to the seaport or airport. Simply choose container, box, or pallet shipping, enter your dimensions and weight, and you’ll get an instant estimate of freight shipping costs.

Types of Incoterms

FOB (Free On Board), EXW (Ex Works) and FCA (Free Carrier) are the most well-known incoterms but there are more to choose from. Which one is right for you depends on factors including what type of goods you’re shipping, your experience as a shipper, and your relationship with your supplier.

Most incoterms can be used for any mode of transport. The exceptions are FOB, FAS, CFR, and CIF, which are used for sea freight only.

Incoterms for Air Freight

Incoterms commonly used for air shipments are:

EXW (Ex-works), in which the buyer assumes responsibility at the seller’s warehouse and takes care of everything including transportation and insurance.

CIP (Carriage and insurance), which puts responsibility for insurance on the seller.

CPT (Carriage Paid To), in which the seller delivers the goods and covers all fees involved in delivering the goods to the named destination. After delivery, the buyer assumes responsibility.

DDP (Delivered Duty Paid), which puts most obligations on the seller. They carry all the costs and risks of transport, insurance, and customs clearance. This is the only incoterm that lists the seller as the importer of record at destination.

DAP-Delivered At Place, where the seller covers the costs involved in main carriage but is not responsible for customs clearance.

Why are Incoterms Important?

Importers and exporters should consider which incoterms is best for them before the contract of sale is negotiated. This can prevent surprise costs and unnecessary complications.

Choosing an incoterm means getting on the same page as your supplier – it aligns everyone on shipping procedures when multiple parties and stakeholders are involved. These globally accepted terms ensure the timely payment of goods, services, and duties, while protecting suppliers, carriers, and buyers.

Incoterms Chart, List & PDF

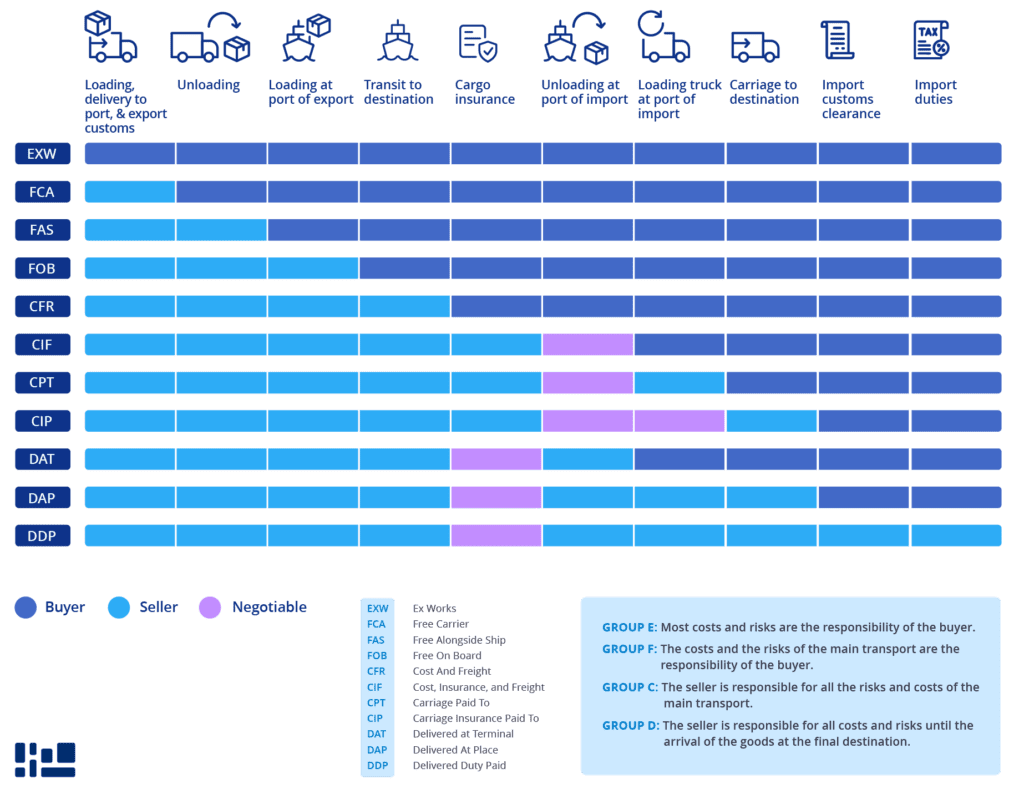

Check out this quick reference of Incoterms and the breakdown of who is responsible for what at various points in the international supply chain.

What Incoterms Should I Use?

Here are some of the most common incoterms and when you might choose them:

FOB (Free on Board)

This very common incoterm is for sea freight only, and means that liability and responsibility for cost transfer to the buyer when the goods are loaded “on board” the shipping vessel.

FOB gives the buyer a high degree of control over the freight shipping process. Since the buyer is choosing their own forwarder, they benefit from greater flexibility with regards to cost, terms, and shipping planning.

The ExWorks incoterm means that responsibility transfers to the buyer at the supplier’s warehouse and not on board the vessel.

This means the buyer pays for and is responsible for goods’ transport every step of the way, from door to door. All the supplier needs to do is prepare the goods for pick up.

This incoterm gives the buyer full control over freight costs, but also means they are responsible for everything that happens in the origin country– which is frequently not their country of residence. More experienced shippers may benefit from using this incoterm.

When using FCA, the buyer assumes responsibility and costs once the goods are loaded onto a mode of transportation or delivered to a specific location agreed upon by the buyer and seller – typically this is a port.

This incoterm is used for all shipping modes.

With FCA, the supplier is responsible for packaging and transport at the origin. This means the supplier has more responsibility than they do with ExWorks, but the buyer still assumes costs and responsibilities earlier than they do when using FOB.

Main Differences Specific to a Country

The above advice covers most countries in most circumstances. But there are some factors to keep in mind when choosing an incoterm with your supplier:

- Customs procedures are much more relaxed at porous borders, like within the EU

- Different countries require different produres and paperwork for shipments: the US requires a Customs Bond, importing into the UK requires a Deferment Account, and exporting from India includes a withholding tax.

When to Challenge Advice

Some freight forwarders prefer only using a favored set of incoterms because they “seem to work.” Therefore don’t be surprised if some forwarders push back on your selection of incoterm, despite it being the most appropriate incoterm for your shipment.

What Shipping Incoterms Don’t Cover

Incoterms do not cover property rights, possible force majeure situations and breach of contract. Include of these within the contract of sale. Similarly, all incoterms except the C terms do not assign responsibility for arranging insurance. Cargo insurance is, therefore, a separate cost for buyers.

Define Named Place in the Sales Contract

When the incoterm is written in the sales contract, the named place should immediately follow the three letter incoterm abbreviation, e.g. “FCA Shenzen Yantian CFS.” Be precise when defining the location, especially with larger cities that may have several terminals, and with larger terminals that may have several drop-off points. You can use this global port finder to find specific port codes.

How Letters of Credit Limit Choice of Incoterm

If the sale is being completed with a letter of credit or documentary credit, the chain that releases funds begins with the seller providing several documents to the bank, including the bill of lading/air waybill. Letters of credit are used where there is limited trust between the seller and the buyer. That rules out EXW, because the supplier will be paid before pickup. F terms require trust because if the buyer cancels the international transit, the supplier won’t have a bill of lading to present to the bank. D terms require trust because the seller is bearing all of the transport costs. That leaves the four C terms as the best options to use with a letter of credit.